Goods and Services Tax (GST) is a broad, multi-step, destination-based tax charged at every stage of value addition in India. Introduced on July 1, 2017, GST has replaced various indirect taxes like VAT, excise duty, and service tax. For small businesses, understanding the importance of GST registration is crucial for compliance, growth, and leveraging various benefits. In this blog, we will delve into why GST registration is vital for small businesses and how it can impact their operations and growth.

What is GST Registration?

GST registration is the process by which a business registers itself under the Goods and Services Tax. Once registered, a business receives a unique Goods and Services Tax Identification Number (GSTIN), which is used for all GST-related transactions and filings. GST registration is mandatory for businesses whose aggregate turnover exceeds a certain threshold, but voluntary registration can also be advantageous for smaller businesses

The Basics of GST

Before diving into the specifics of GST registration, it is essential to understand the basics of GST. GST is a destination-based tax that is levied on the supply of goods and services. It is implemented to create a unified tax system in India by consolidating various indirect taxes. GST is categorized into three types:

- Central Goods and Services Tax (CGST): Imposed by the central government on supplies within a state.

- State Goods and Services Tax (SGST): Imposed by the state government on supplies within the same state.

- Integrated Goods and Services Tax (IGST): Levied by the central government on inter-state supplies.

The implementation of GST aims to eliminate the cascading effect of taxes, reduce tax evasion, and promote transparency in the tax system.

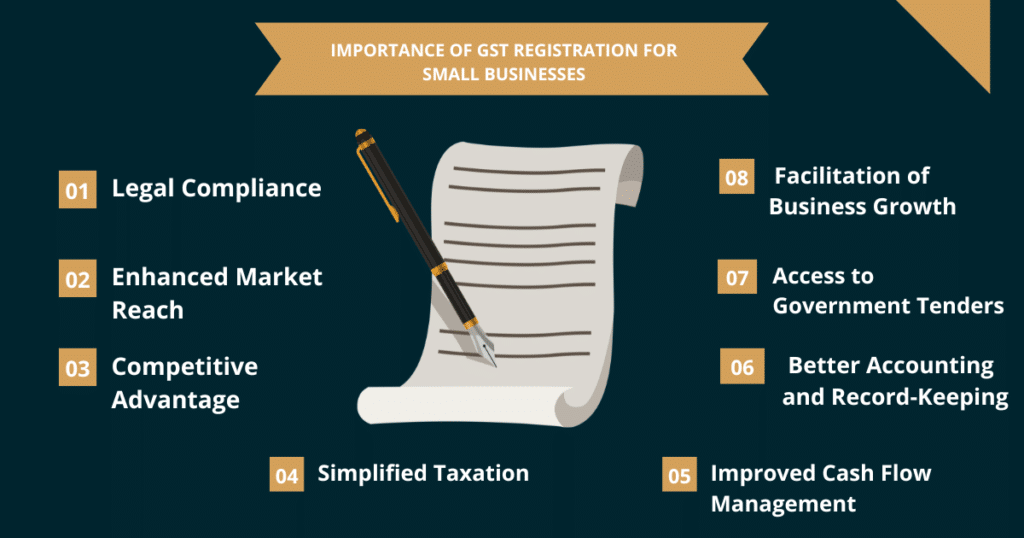

Importance of GST Registration for Small Businesses

1. Legal Compliance

Mandatory Compliance: GST registration is mandatory for businesses with an annual turnover exceeding ₹40 lakhs (₹20 lakhs for North-Eastern and hill states). Non-compliance can lead to heavy penalties and legal issues, including fines and potential legal action.

Input Tax Credit (ITC): Registered businesses can claim Input Tax Credit, which allows them to reduce the tax they have already paid on inputs from the tax they need to pay on outputs. This can greatly lower the total tax burden and enhance cash flow.

Credibility and Trust: GST registration enhances the credibility of a business. Customers and partners are more likely to trust and engage with a business that is GST compliant, as it reflects professionalism and adherence to legal norms.

2. Enhanced Market Reach

Interstate Trade: Without GST registration, businesses are restricted to intra-state sales. GST registration allows businesses to engage in interstate trade, thereby expanding their market reach and growth opportunities.

E-commerce Participation: GST registration is mandatory for businesses that wish to sell their products or services online through e-commerce platforms. This opens up new avenues for sales and marketing, providing access to a broader customer base.

3. Competitive Advantage

Better Pricing: Businesses with GST registration can offer competitive pricing by leveraging the Input Tax Credit. This advantage allows them to reduce costs and offer better prices to customers compared to non-registered businesses.

Avoidance of Cascading Effect: GST eliminates the cascading effect of taxes, where tax is levied on tax. By ensuring that tax is only charged on the value addition at each stage, GST helps businesses maintain better pricing strategies and enhances competitiveness.

4. Simplified Taxation

Unified Tax Structure: GST replaces multiple indirect taxes with a single, unified tax structure. This simplification reduces the complexity of managing various taxes and compliance requirements, making it easier for small businesses to operate.

Ease of Filing Returns: The GST regime has streamlined the process of filing tax returns. With online portals and simplified forms, businesses can easily file their returns, reducing the administrative burden and ensuring timely compliance.

5. Improved Cash Flow Management

Efficient ITC Mechanism: The Input Tax Credit mechanism under GST ensures that businesses can claim credit for the tax paid on purchases. This reduces the overall tax liability and improves cash flow management, allowing businesses to reinvest in growth and operations.

Timely Refunds: GST provides for timely refunds of excess tax paid, which can significantly improve the cash flow of small businesses. This is especially beneficial for exporters and businesses with zero-rated supplies.

6. Better Accounting and Record-Keeping

Structured Accounting: GST requires systematic accounting and record-keeping of all transactions. This promotes better financial discipline and transparency within the business.

Audit Trail: Maintaining accurate records under GST ensures a clear audit trail, which can be beneficial during audits and assessments. This reduces the risk of discrepancies and potential penalties.

7. Access to Government Tenders

Eligibility for Tenders: Many government tenders require GST registration as a pre-qualification criterion. By registering under GST, small businesses can participate in these tenders, opening up new business opportunities and revenue streams.

8. Facilitation of Business Growth

Scalability: GST registration enables small businesses to scale operations without the constraints of unregistered status. With access to wider markets, better pricing, and improved cash flow, businesses can focus on growth and expansion.

Professionalism: Being GST compliant portrays a professional image, which can attract better business partnerships, investors, and customers. It signals that the business adheres to legal norms and is committed to maintaining high standards.

Detailed Benefits of GST Registration

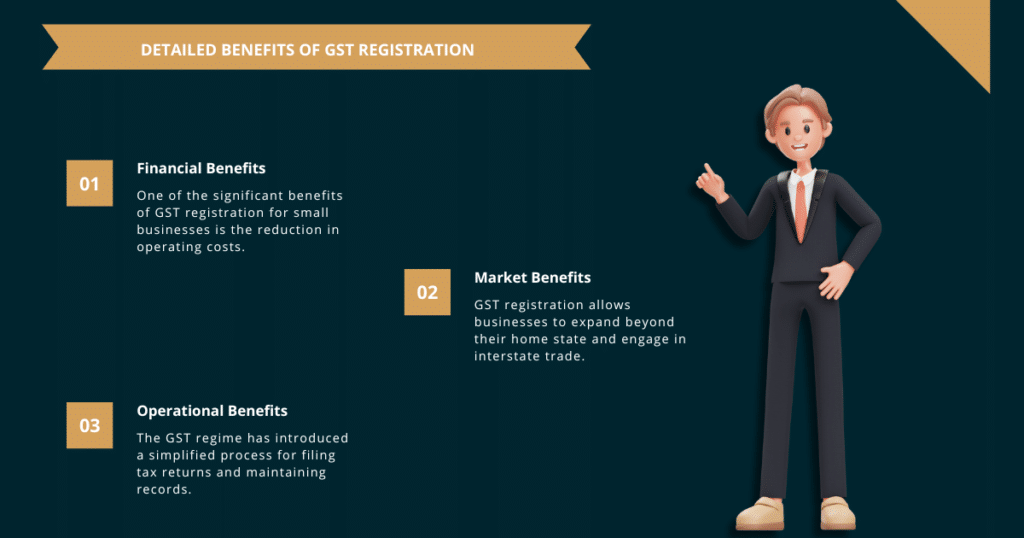

A. Financial Benefits

Reduction in Operating Costs: One of the significant benefits of GST registration for small businesses is the reduction in operating costs. The Input Tax Credit allows businesses to claim the tax paid on purchases, which can significantly lower the overall tax burden.

Access to Working Capital: With better cash flow management and timely refunds, businesses can access more working capital. This can be reinvested in the business to drive growth and expansion.

Increased Profit Margins: By leveraging the Input Tax Credit and eliminating the cascading effect of taxes, businesses can reduce costs and increase profit margins. This makes the business more competitive in the market.

B. Market Benefits

Access to New Markets: GST registration allows businesses to expand beyond their home state and engage in interstate trade. This opens up new markets and customer bases, providing opportunities for growth.

Enhanced Customer Base: With GST registration, businesses can sell their products and services online through e-commerce platforms. This provides access to a larger and more diverse customer base.

Improved Competitive Edge: Businesses that are GST registered can offer better pricing and have a competitive edge over non-registered businesses. This can help attract more customers and increase market share.

C. Operational Benefits

Streamlined Operations: GST simplifies the tax structure by consolidating various indirect taxes into one. This reduces the complexity of managing multiple taxes and compliance requirements, making it easier for businesses to operate.

Efficient Supply Chain: With the elimination of the cascading effect of taxes and better cash flow management, businesses can streamline their supply chain operations. This leads to improved efficiency and cost savings.

Reduced Compliance Burden: The GST regime has introduced a simplified process for filing tax returns and maintaining records. This reduces the administrative burden on businesses and ensures timely compliance.

Steps to Register for GST

- Online Application:

- Visit the GST portal (gst.gov.in) and click on ‘Register Now’.

- Fill in the required details such as PAN, mobile number, and email ID.

- You will receive an OTP for verification.

- Submission of Documents:

- Submit the necessary documents, including PAN card, proof of business registration, identity and address proof of promoters/directors, and bank account details.

- Submit the necessary documents, including PAN card, proof of business registration, identity and address proof of promoters/directors, and bank account details.

- Application Reference Number (ARN):

- After submission, you will receive an Application Reference Number (ARN) for tracking the application status.

- After submission, you will receive an Application Reference Number (ARN) for tracking the application status.

- GSTIN Issuance:

- Once the application is processed and verified, a unique GSTIN is issued.

- Once the application is processed and verified, a unique GSTIN is issued.

- Completion of Registration:

- After receiving the GSTIN, you need to complete the registration process by logging into the GST portal and providing additional information as required.

Documents Required for GST Registration

To complete the GST registration process, businesses need to submit the following documents:

- PAN Card: A copy of the business’s PAN card is mandatory for registration.

- Proof of Business Registration: Documents such as the partnership deed, incorporation certificate, or any other proof of business registration.

- Identity Proof: Aadhaar card, passport, or voter ID card of the promoters/directors.

- Address Proof: Utility bills, rent agreement, or property tax receipts as proof of business address.

- Bank Account Details: A copy of the bank statement, canceled cheque, or passbook.

- Photographs: Passport-sized photographs of the promoters/directors.

Common Challenges in GST Registration

While GST registration offers numerous benefits, small businesses may face some challenges during the registration process:

Complex Documentation: The requirement for various documents can be overwhelming for small businesses, especially those without a dedicated accounting team.

Technical Issues: The GST portal may experience technical glitches, causing delays in the registration process.

Compliance with Regulations: Understanding and complying with the various regulations and requirements under the GST regime can be challenging for small businesses.

Overcoming Challenges

Professional Assistance: Engaging professional advisors such as chartered accountants or tax consultants can help businesses navigate the complexities of GST registration and compliance.

Regular Updates: Staying informed about the latest updates and changes in GST regulations can help businesses avoid non-compliance and penalties.

Use of Technology: Leveraging technology and online tools can simplify the process of filing returns and maintaining records under GST.

Conclusion

GST registration is not just a legal obligation but a strategic move that can significantly benefit small businesses. From enhancing market reach and competitiveness to improving cash flow and facilitating growth, GST registration offers numerous advantages. Small businesses should prioritize GST registration to ensure compliance, leverage benefits, and pave the way for sustainable growth and success.

At Legally Sahi, we understand the complexities of GST registration and compliance.Our expert team is here to assist you at every stage, ensuring a smooth and hassle-free experience. Contact us today to learn more about how we can assist you in achieving GST compliance and unlocking the full potential of your business.

FAQs

Q-1. What is the threshold limit for GST registration?

Ans: The threshold limit for GST registration is ₹40 lakhs for most states and ₹20 lakhs for North-Eastern and hill states. However, there are exceptions for certain businesses and services.

Q- 2. Can I voluntarily register for GST?

Ans: Yes, businesses with turnover below the threshold limit can voluntarily register for GST to avail of its benefits, such as Input Tax Credit and enhanced market reach.

Q- 3. How long does it take to get a GSTIN?

The processing time for GST registration typically ranges from 3 to 7 working days, provided all documents are in order and there are no technical issues with the GST portal.

Q-4. What are the penalties for non-compliance with GST?

Penalties for non-compliance can include fines, interest on unpaid taxes, and legal action. The penalty can be up to 10% of the tax amount due, subject to a minimum of ₹10,000.

Q-5 How frequently do I need to file GST returns?

GST returns need to be filed monthly and annually. The frequency of filing may vary based on the type of business and turnover. Regular updates and compliance with deadlines are crucial to avoid penalties.