In today’s rapidly evolving economic landscape, small businesses form the backbone of India’s economy. The Micro, Small, and Medium Enterprises (MSME) sector plays a pivotal role in fostering innovation, creating employment, and contributing to the country’s GDP. Recognizing the importance of MSMEs, the Indian government has introduced various schemes and initiatives to support and nurture this sector. One such initiative is the MSME registration, which offers a multitude of benefits to small businesses. In this comprehensive guide, we will delve into the benefits and procedure of MSME registration, and how Legally Sahi, a reputed law firm, can assist you in navigating this process with ease.

Understanding MSME

Before we explore the benefits and procedure of MSME registration, it is crucial to understand what constitutes an MSME. The classification of MSMEs in India is based on the investment in plant and machinery or equipment and the annual turnover of the enterprise. As per the latest revision in the MSME classification, the criteria are as follows:

- Micro Enterprises:

- Investment in plant and machinery or equipment: Up to INR 1 crore

- Annual turnover: Up to INR 5 crore

- Small Enterprises:

- Investment in plant and machinery or equipment: Up to INR 10 crore

- Annual turnover: Up to INR 50 crore

- Medium Enterprises:

- Investment in plant and machinery or equipment: Up to ₹50 crore

- Annual turnover: Up to INR 250 crore

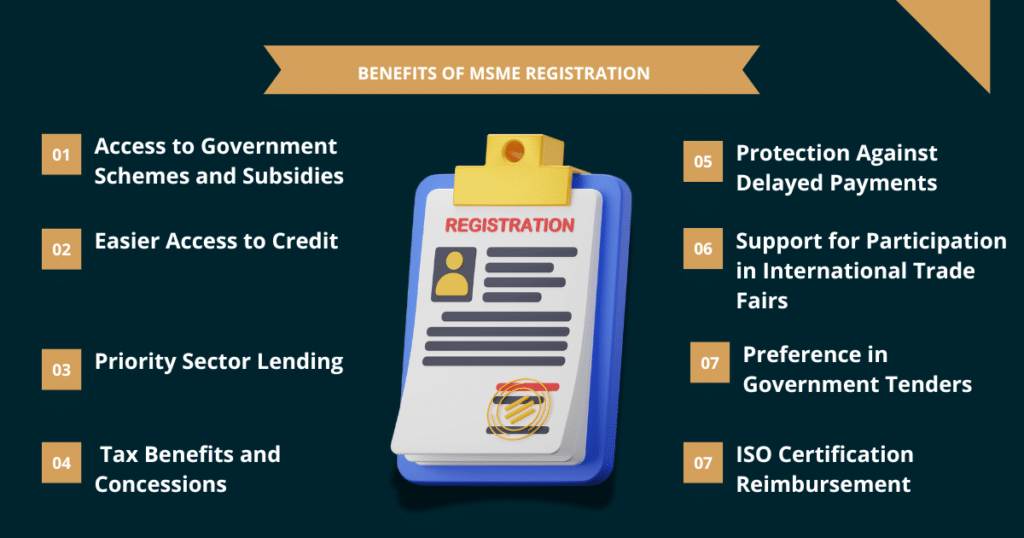

Benefits of MSME Registration

MSME registration opens the door to a plethora of benefits for small businesses, helping them grow and compete in the market. Here are some of the key advantages of registering as an MSME:

1. Access to Government Schemes and Subsidies

Registered MSMEs can avail of various government scheme and subsidies designed to promote and support small businesses. These include:

- Credit Linked Capital Subsidy Scheme (CLCSS): Provides capital subsidy for upgrading technology.

- Prime Minister’s Employment Generation Programme (PMEGP): Offers financial assistance for setting up new enterprises.

- Micro and Small Enterprises Cluster Development Programme (MSE-CDP): Aims at enhancing the productivity and competitiveness of MSMEs through cluster development.

2. Easier Access to Credit

One of the most significant challenges faced by small businesses is access to credit. MSME registration facilitates easier access to loans from banks and financial institutions at lower interest rates. Many financial institutions offer collateral-free loans to registered MSMEs under schemes like the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE).

3. Priority Sector Lending

Registered MSMEs are classified under the priority sector by banks, which means they are given preference when it comes to lending. This priority sector lending ensures that a certain portion of the bank’s lending goes to MSMEs, facilitating better access to financial resources.

4. Tax Benefits and Concessions

MSMEs are eligible for various tax benefits and concessions. For instance, they can avail of a tax holiday under the Income Tax Act, exemptions from certain direct taxes, and concessions on excise duty. These benefits help in reducing the financial burden on small businesses.

5. Protection Against Delayed Payments

MSME registration offers protection against delayed payments from buyers. As per the MSME Development Act, 2006, if a buyer fails to make the payment within 45 days of accepting the goods or services, the MSME is entitled to interest on the delayed payment. This provision ensures better cash flow management for small businesses.

6. Support for Participation in International Trade Fairs

Registered MSMEs receive financial support from the government for participating in international trade fairs and exhibitions. This exposure helps small businesses explore new markets, showcase their products, and expand their customer base globally.

7. Preference in Government Tenders

The government provides a certain reservation for MSMEs in public procurement, ensuring that a fixed percentage of tenders are allotted to small businesses. This preference in government tenders provides MSMEs with significant business opportunities.

8. ISO Certification Reimbursement

To enhance quality and competitiveness, the government offers reimbursement for the expenses incurred in obtaining ISO certification. This initiative encourages MSMEs to adopt international quality standards.

Procedure for MSME Registration

The Process of MSME registration in India is straightforward and can be completed online. Here is a step-by-step guide to assist you in navigating the registration process:

Step 1: Visit the Udyam Registration Portal

The first step is to visit the official Udyam Registration portal (https://udyamregistration.gov.in). This portal is a one-stop destination for MSME registration and related services.

Step 2: Provide Aadhaar Number

Enter the Aadhaar number of the business owner or the authorized signatory. Aadhaar is mandatory for MSME registration. If the applicant is a proprietor, the Aadhaar number of the proprietor is required. In the case of a partnership firm or a company, the Aadhaar number of the managing partner or director is needed.

Step 3: Validate and Generate OTP

Once the Aadhaar number is entered, validate it using the OTP sent to the registered mobile number linked with the Aadhaar. Enter the OTP to proceed.

Step 4: Fill in the Registration Details

Fill in the necessary details, including the name of the enterprise, type of organization, PAN number, location of the plant, official address, and bank account detailsMake sure all the information provided is accurate and current.

Step 5: Classification of Enterprise

Select the appropriate classification of the enterprise (micro, small, or medium) based on the investment in plant and machinery or equipment and the annual turnover.

Step 6: Submit and Generate Udyam Registration Certificate

Once you have filled in all the required details, submit the application. Upon successful submission, an acknowledgment number is generated, and the Udyam Registration Certificate is issued. This certificate is a testament to the enterprise’s registration as an MSME and can be downloaded from the portal.

Post-Registration Compliance

Once registered, MSMEs need to adhere to certain compliance requirements to maintain their status and continue enjoying the benefits. These include:

- Annual Return Filing: MSMEs must file annual returns detailing their financial performance and other relevant information.

- Adherence to Statutory Regulations: MSMEs need to comply with various statutory regulations, including labor laws, environmental regulations, and industry-specific guidelines.

- Renewal of Registration: Although the Udyam Registration does not require renewal, MSMEs must ensure that their registration details are updated periodically.

How Legally Sahi Can Help

Navigating the process of MSME registration and ensuring compliance with legal requirements can be daunting for small business owners. This is where Legally Sahi, a reputable law firm, comes in. With their extensive expertise in legal matters and a deep understanding of the MSME sector, Legally Sahi offers comprehensive support to businesses seeking MSME registration.

Free Consultation

Legally Sahi provides free consultation services to help you understand the benefits of MSME registration and guide you through the process. Their team of experienced legal professionals is available to answer your questions, address your concerns, and provide personalized advice tailored to your business needs.

Hassle-Free Registration

From conducting preliminary checks to filing the registration application, Legally Sahi ensures a hassle-free registration process. Their experts assist you in filling out the necessary forms, verifying documents, and ensuring compliance with all legal requirements. This comprehensive support saves you time and effort, allowing you to focus on your core business activities.

Post-Registration Compliance

Maintaining MSME status involves adhering to various compliance requirements. Legally Sahi offers ongoing support to help you stay compliant with statutory regulations. Their services include annual return filing, regulatory updates, and assistance with audits and inspections.

Legal Representation

In case of any legal disputes or challenges related to your MSME status, Legally Sahi provides robust legal representation.

Business Growth and Expansion

Legally Sahi goes beyond registration and compliance support. They offer strategic advice on leveraging MSME benefits for business growth and expansion. Whether it’s accessing government schemes, exploring funding options, or participating in international trade fairs, Legally Sahi provides valuable insights to help your business thrive.

Conclusion

MSME registration is a critical step for small businesses in India, offering a wide array of benefits that can significantly enhance growth and sustainability. From access to government schemes and easier credit facilities to tax benefits and protection against delayed payments, the advantages of MSME registration are substantial. The registration process, while straightforward, requires careful attention to detail and adherence to legal requirements.

At Legally Sahi, we understand the unique challenges faced by small businesses and are committed to providing comprehensive legal support. Our free consultation services, coupled with expert guidance throughout the registration process, ensure that your business can unlock the full potential of MSME benefits. By partnering with Legally Sahi, you can navigate the complexities of MSME registration with confidence and focus on what you do best – growing your business.

Don’t miss out on the opportunities that MSME registration offers. Contact Legally Sahi today for a free consultation and take the first step towards securing a prosperous future for your small business. Let us help you protect, grow, and succeed in the competitive market landscape.