In the realm of financial transactions and loan defaults, the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act, 2002, plays a pivotal role in empowering banks to recover their dues efficiently. For borrowers facing the heat of Sarfaesi proceedings, understanding their rights and the measures they can take against banks becomes crucial.

Applicability of SARFAESI Act, 2002

The SARFAESI Act, 2002, is applicable to all financial institutions, including banks and housing finance companies, for the enforcement of security interests. It applies when borrowers default on their loans, enabling secured creditors to take possession of secured assets and sell them to recover dues. This Act is instrumental in addressing non-performing assets (NPAs) and expediting the recovery process without lengthy court proceedings.

Role of SARFAESI Act, 2002

The primary role of the SARFAESI Act is to empower secured creditors with the authority to enforce security interests without court intervention. This includes:

- Seizing and selling the mortgaged property.

- Assigning the rights over secured assets to asset reconstruction companies.

- Managing and resolving non-performing assets.

How SARFAESI Act, 2002 Works

The SARFAESI Act provides a structured process for the enforcement of security interests:

- Issuance of Notice: Banks issue a notice under Section 13(2) to the borrower, demanding payment within 60 days.

- Possession of Assets: If the borrower fails to repay, the bank can take possession of the secured asset under Section 13(4).

- Auction of Assets: The bank can auction the seized assets to recover the outstanding dues.

- Role of District Magistrate: Under Section 14, the District Magistrate must assist in taking possession of the secured asset within 30 days, extendable to 60 days for recorded reasons.

Formation of SARFAESI Act, 2002

The SARFAESI Act was enacted in response to the growing issue of non-performing assets in the banking sector. It was designed to provide a legal framework for the securitization and reconstruction of financial assets, as well as the enforcement of security interests. The Act aimed to improve the recovery process, making it more efficient and less dependent on lengthy legal proceedings.

Key Features of SARFAESI Act, 2002

1. Securitization:

- Financial institutions can convert illiquid assets into marketable securities. This process helps in improving liquidity and reducing the burden of NPAs.

2. Asset Reconstruction:

- Asset Reconstruction Companies (ARCs) can buy NPAs from banks at a discounted rate. These ARCs then work on restructuring and resolving these assets.

3. Enforcement of Security Interest:

- Banks and financial institutions can enforce their security interests without approaching the courts. This involves taking possession of secured assets and selling them to recover dues.

4. Central Registry:

- The Act mandates the creation of a Central Registry of Securitisation Asset Reconstruction and Security Interest of India (CERSAI). This helps in preventing frauds involving multiple lending against the same property.

Measures Available to Borrowers Against Banks

1. Legal Scrutiny of Default Notice:

- Banks must issue a proper default notice under Section 13(2) of the Sarfaesi Act. Borrowers can challenge the validity of this notice if it is not issued in accordance with the law.

2. Right to File Objections:

- Borrowers have the right to file objections with the Debt Recovery Tribunal (DRT) against the actions proposed by the bank under Section 17 of the Act. This includes challenging the bank’s valuation of the property or any procedural lapses.

3. Seeking Stay Orders:

- Borrowers can approach the DRT or the High Court seeking a stay order against the bank’s actions under Section 17(1-A). This can temporarily halt the auction proceedings if procedural irregularities are identified.

4. Negotiation and Settlement:

- Banks are open to negotiations for the settlement of dues. Borrowers can explore this option to restructure their loans or seek more favorable repayment terms.

5. Challenging Auction Proceedings:

- Borrowers can challenge the auction proceedings if they believe the bank has not followed due process or if there are discrepancies in valuation or notice issuance.

6. Section 14: Role of the District Magistrate:

- Section 14 of the SARFAESI Act mandates that the District Magistrate must deliver possession of a secured asset to banks within 30 days. This period can be extended to a maximum of 60 days if the reasons are recorded in writing. Borrowers can ensure that this process is followed correctly and raise objections if there are deviations.

7. Court Rulings:

- The Kerala High Court has clarified that if a secured creditor opts to file a civil suit for recovery of dues and it gets dismissed, the creditor cannot proceed with recovery measures under the SARFAESI Act. Justice Easwaran S. emphasized that banks cannot ignore the civil suit outcome and initiate recovery proceedings afresh under the SARFAESI Act.

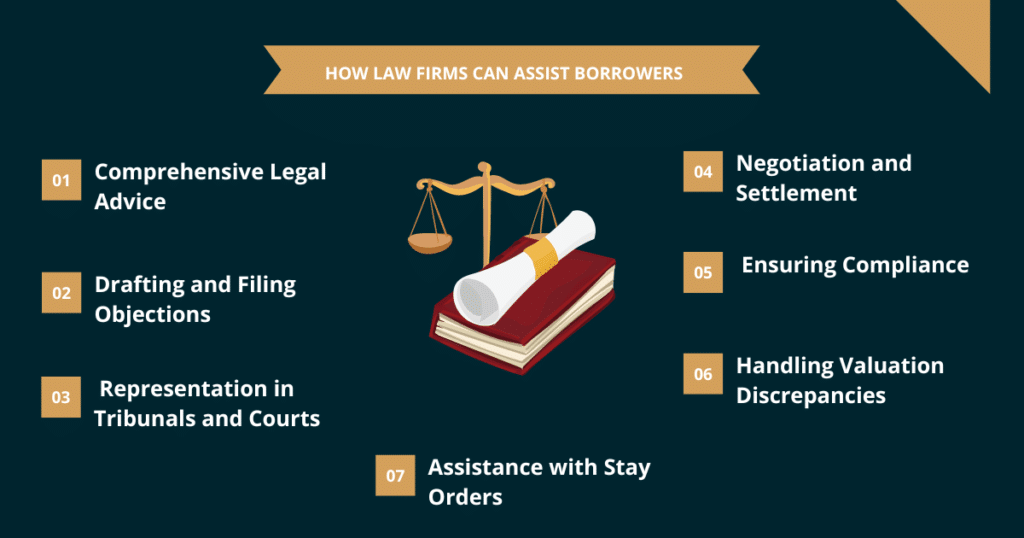

How Law Firms Can Assist Borrowers

Navigating the intricacies of the SARFAESI Act can be daunting for borrowers. This is where the expertise of a law firm can make a significant difference:

1. Comprehensive Legal Advice:

Law firms provide detailed legal advice on borrowers’ rights under the SARFAESI Act. They help in understanding the implications of each notice and action taken by the bank.

2. Drafting and Filing Objections:

Legal experts can draft and file objections to the default notices and actions proposed by banks. They ensure that all objections are legally sound and backed by relevant provisions of the Act.

3. Representation in Tribunals and Courts:

Law firms represent borrowers before the Debt Recovery Tribunal (DRT), the Appellate Tribunal, and higher courts. They present the borrower’s case effectively, challenging any procedural lapses or unfair actions by the bank.

4. Negotiation and Settlement:

Experienced lawyers can negotiate with banks on behalf of borrowers to restructure loans or settle dues. They aim to achieve the most favorable terms for their clients.

5. Ensuring Compliance:

Law firms ensure that banks comply with all legal procedures under the SARFAESI Act. They scrutinize every action taken by the bank to protect the interests of the borrower.

6. Handling Valuation Discrepancies:

If there are discrepancies in the valuation of the property, legal experts can challenge the undervaluation and ensure a fair assessment is conducted.

7. Assistance with Stay Orders:

Law firms assist in obtaining stay orders from the DRT or courts, temporarily halting any adverse actions by banks until the matter is resolved.

Recent Developments and Judicial Pronouncements

1. Borrowers’ Rights:

- Recent rulings have emphasized the rights of borrowers to ensure fair treatment. Courts have ruled against arbitrary actions by banks, reinforcing the need for procedural adherence.

2. Valuation Discrepancies:

- There have been cases where borrowers successfully challenged the undervaluation of their properties during auctions. Ensuring accurate and fair valuation is crucial for both parties.

3. Transparency in Auctions:

- Courts have mandated that auctions under the SARFAESI Act must be transparent. Any deviation from the prescribed process can lead to the annulment of the auction.

4. Restructuring Opportunities:

- Borrowers can explore restructuring their loans through negotiations. Banks are often willing to consider restructuring to avoid lengthy recovery processes and litigation.

Conclusion

Navigating Sarfaesi proceedings requires a thorough understanding of legal nuances and the rights available to borrowers. While banks have legal powers to recover debts, borrowers have several measures at their disposal to challenge actions that are not conducted in accordance with the law. Seeking legal counsel and understanding one’s rights can significantly impact the outcome of Sarfaesi proceedings, ensuring fair treatment and procedural integrity.

For borrowers facing impending Sarfaesi actions, consulting with legal experts can provide clarity on the best course of action to protect their interests and challenge bank actions effectively. A law firm can offer comprehensive support, from drafting objections to representing borrowers in courts, ensuring that every step taken is legally sound and in the borrower’s best interest.

At Legally Sahi, we specialize in guiding borrowers through the complexities of Sarfaesi proceedings. If you need any legal help, contact us—we provide free consultations to help you navigate your legal challenges effectively. Stay informed, stay empowered with Legally Sahi!